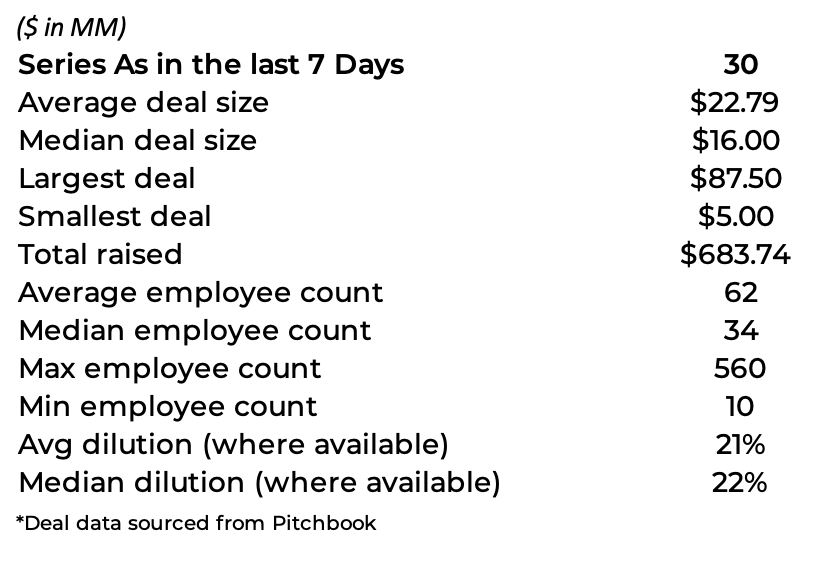

Summary Stats

I’ve started asking Claude to use the weekly data to figure out which are the most interesting companies each week. We’re going to watch these picks over the next year and see how they perform.

Those responses are below the full list of this week’s deals. Claude seems to like robots, and the power systems necessary for more AI.

All Series A Deals

AgentAI raised $22 million at an unknown valuation from Eir Partners and Transformation Capital on September 2, 2025. The CEO is Zorik Gordon. AgentAI is based in Los Angeles, CA. AgentAI is an operator of artificial intelligence-powered automation intended to quickly automate a large portion of coding and billing tasks. Website: www.agentai.app

Cariina raised $5.58 million at a $25.68 million valuation from Jason Krantz on September 2, 2025. The CEO is Matthew Barron. Cariina is based in Boston, MA. Cariina is a developer of an operations enablement platform designed to promote safety, efficiency and transparency within schools. Website: www.cariina.com

Flex raised $15 million at a $48.52 million valuation from Cameron Ventures, Core Innovation Capital, First Round Capital, and ReThink Capital on September 2, 2025. The CEO is Sam OKeefe. Flex is based in Sacramento, CA. Flex is an operator of a payment platform intended for businesses to accept flexible spending accounts (FSA) and health savings accounts (HSA) cards. Website: www.withflex.com

Intella raised $12.5 million at an unknown valuation from Prosus Ventures on September 2, 2025. The CEO is Nour Taher. Intella is based in Giza, Egypt. Intella is a developer of a cloud-based on-demand insights platform designed to deliver real-time consumer insights and create surveys. Website: www.intella.me

LightYX raised $11 million at an unknown valuation from Saint-Gobain NOVA on September 2, 2025. The CEO is Guy Benromano. LightYX is based in New York, NY. LightYX is a developer of a laser-accurate construction layout and 3D scanning tool designed for automating the transfer of digital models into visible field layouts. Website: www.lightyx.com

Omniretail raised $20 million at an unknown valuation from Norfund and Timon Capital on September 2, 2025. The CEO is Deepankar Rustagi. Omniretail is based in Lagos, Nigeria. Omniretail is a developer of a unified distribution platform designed to digitize the supply chain from manufacturers through distributors to retailers. Website: www.omniretail.africa

Rive raised $8.5 million at a $131 million valuation from BMW i Ventures on September 2, 2025. The CEO is Guido Rosso. Rive is based in San Francisco, CA. Rive is a developer of a real-time animation platform designed to bring applications and games to life with various animations. Website: www.rive.app

Tangany raised $11.66 million at an unknown valuation from Baader Bank, Elevator Ventures, and Heliad on September 2, 2025. The CEO is Martin Kreitmair. Tangany is based in Munich, Germany. Tangany is a developer of a blockchain wallet platform designed to offer custody of digital assets and crypto. Website: tangany.com

ZettaBlock raised $18 million at an unknown valuation from General Catalyst and PayPal Ventures on September 2, 2025. The CEO is Chi Zhang. ZettaBlock is based in Palo Alto, CA. ZettaBlock is a developer of an open AI development infrastructure platform designed for an accessible ecosystem of models and datasets. Website: www.zettablock.com

Flybotix raised $10 million at an unknown valuation from Greeneering Invest on September 3, 2025. The CEO is Samir Bouabdallah. Flybotix is based in Lausanne, Switzerland. Flybotix is a developer of aerial systems designed for indoor inspections in confined spaces. Website: www.flybotix.com

Orchard Robotics raised $22 million at an unknown valuation from Quiet Capital and Shine Capital on September 3, 2025. The CEO is Charles Wu. Orchard Robotics is based in Ithaca, NY. Orchard Robotics is an operator of a smart farming company intended for precision crop management. Website: www.orchard.ai

PeakMetrics raised $7.16 million at a $34.5 million valuation on September 3, 2025. The CEO is Nicholas Loui. PeakMetrics is based in Los Angeles, CA. PeakMetrics is a developer of a narrative intelligence platform designed to help enterprises and governments identify and combat emerging online narrative threats. Website: www.peakmetrics.com

PlatinumRx raised $6 million at an unknown valuation from Stellaris Venture Partners on September 3, 2025. The CEO is Ashutosh Pandey. PlatinumRx is based in Bengaluru, India. PlatinumRx is an operator of a pharma industry online platform intended to order medicines without middlemen. Website: www.platinumrx.in

Reveal HealthTech raised $9.85 million at a $25 million valuation from Leo Capital on September 3, 2025. The CEO is Sanchit Mullick. Reveal HealthTech is based in New York, NY. Reveal HealthTech is a developer of a healthcare technology platform designed to provide cross-functional technology services to healthcare companies. Website: www.revealhealthtech.com

RushOwl raised $10 million at an unknown valuation from Gobi Partners on September 3, 2025. The CEO is Shin Ng. RushOwl is based in Singapore, Singapore. RushOwl is a developer of a bus pooling and electronic travel authorization (ETA) tracking application designed to help passengers track and book their bus journey. Website: www.rushowl.app

Tidal Cyber raised $10 million at a $60 million valuation from Bright Pixel Capital on September 3, 2025. The CEO is Richard Gordon. Tidal Cyber is based in Clifton, VA. Tidal Cyber is a developer of a threat-informed defense platform designed to shift cybersecurity from reactive vulnerability management to proactive, adversary-behavior-centric protection. Website: www.tidalcyber.com

Utila raised $22 million at an unknown valuation from Red Dot Capital Partners on September 3, 2025. The CEO is Bentzi Rabi. Utila is based in Dover, DE. Utila is a developer of a digital asset operations platform designed to help institutions securely manage and build on digital assets. Website: www.utila.io

Akto raised $7 million at an unknown valuation from Accel on September 4, 2025. The CEO is Ankita Gupta. Akto is based in San Francisco, CA. Akto is a developer of an open source application programming interface security platform designed to see, secure, manage and unmanage application programming interfaces for potentially malicious activity. Website: www.akto.io

Euclid Power raised $20 million at an unknown valuation from Venrock on September 4, 2025. The CEO is Jacob Sandry. Euclid Power is based in Bloomington, MN. Euclid Power is a developer of a renewable energy investment platform designed to guide through the execution of projects at all stages of the project lifecycle. Website: www.euclidpower.com

Pointsville raised $10 million at an $84 million valuation from Valor Capital Group on September 4, 2025. The CEO is Gabor Gurbacs. Pointsville is based in Wilmington, DE. Pointsville is an operator of digital asset platforms designed to bridge traditional financial systems with emerging technologies. Website: www.pointsville.com

Vouched raised $17 million at an unknown valuation from SpringRock Ventures on September 4, 2025. The CEO is Peter Horadan. Vouched is based in Seattle, WA. Vouched is a developer of an identity verification software designed to facilitate real-time fraud detection. Website: www.vouched.id

Augment raised $85 million at an unknown valuation from Redpoint Ventures on September 4, 2025. The CEO is Harish Abbott. Augment is based in Austin, TX. Augment is a developer of an autonomous AI assistants platform designed to optimize logistics operations. Website: www.goaugment.com

Cresilon raised $42 million at an unknown valuation from Catalio Capital Management and William Paseman on September 4, 2025. The CEO is Joseph Landolina. Cresilon is based in New York, NY. Cresilon is a developer of hemostatic products designed to support the natural clotting and promote wound healing. Website: www.cresilon.com

Fernride raised $87.5 million at an unknown valuation from multiple investors including 10x Founders, Bayern Kapital, Fly Ventures, Munich Re Ventures, and Speedinvest on September 4, 2025. The CEO is Hendrik Kramer. Fernride is based in Munich, Germany. Fernride is a developer of logistics automation vehicles designed to improve productivity, safety, and sustainability for fleet operations. Website: www.fernride.com

Sola raised $35 million at an unknown valuation from S32 on September 4, 2025. The CEO is Guy Flechter. Sola is based in Miami, FL. Sola is a developer of cybersecurity tools designed for simplifying security management and compliance. Website: www.sola.security

Etherealize raised $40 million at an unknown valuation from Electric Capital and Paradigm on September 3, 2025. The CEO is Vivek Raman. Etherealize is based in New York, NY. Etherealize is a developer of blockchain infrastructure designed for secure and compliant digital asset ecosystems. Website: www.etherealize.com

FirstClub raised $23 million at a $120 million valuation from Accel and RTP Global on September 3, 2025. The CEO is Ayyappan Rajagopal. FirstClub is based in Bangalore, India. FirstClub is an operator of a quality-first grocery application intended to offer grocery and related products. Website: www.firstclub.site

Vector raised $61 million at an unknown valuation from Alumni Ventures, Dauntless Ventures, GSBackers, Harpoon Ventures, Kickstart, Lightspeed Venture Partners, Pelion Venture Partners, Point72 Ventures, R7, Run Ventures, Shield Capital, and The Cambria Group on September 3, 2025. The CEO is Andy Yakulis. Vector is based in Arlington, VA. Vector is an operator of defense technology intended to deliver practical tools and insights to support military operations. Website: www.tfvector.com

PreDoc raised $30 million at an unknown valuation from Base10 Partners on September 2, 2025. The CEO is Nishant Hari. PreDoc is based in New York, NY. PreDoc is a developer of a healthcare management platform designed for concierge medical practices and remote digital care clinics. Website: memrhealth.com

Claude’s view on the three most interesting deals

2. Vector ($61M from 12 investors) - The defense technology company's substantial funding round from a consortium including Lightspeed Venture Partners, Point72 Ventures, and multiple defense-focused VCs demonstrates the continued strong appetite for defense tech investments. The diverse investor syndicate suggests broad confidence in military technology innovation.

3. Etherealize ($40M from Electric Capital and Paradigm) - This blockchain infrastructure deal stands out for attracting two of crypto's most prestigious VCs. The company's focus on bringing Wall Street onto Ethereum through compliant institutional infrastructure represents a significant step toward mainstream financial adoption of blockchain technology.

Disclosures

This material is intended for information purposes only and does not constitute investment advice, a recommendation or an offer or solicitation to purchase or sell any securities to any person in any jurisdiction in which an offer, solicitation, purchase or sale would be unlawful under the securities laws of such jurisdiction. Unless otherwise stated, all views or opinions herein are solely those of the author(s), and thus any view, comments, or outlook expressed in this communication may differ substantially from any similar material issued by other persons or entities. The information contained in this communication is based on generally available information and although obtained from sources believed to be reliable, its accuracy and completeness cannot be assured and such information may be incomplete or condensed. The information in this communication does not constitute tax, financial, or legal advice.

Originally published on PostRound. For more details, visit the source.